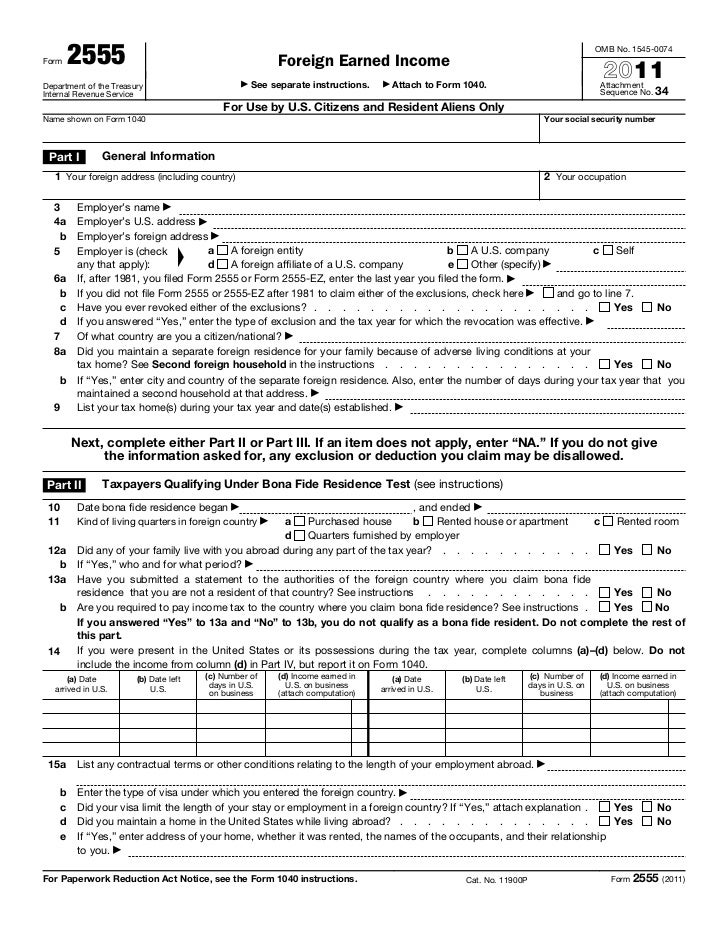

Form 2555 instructions

You cannot exclude or deduct more than your foreign earned income for the year. The form may look confusing, but with the help of instructions on the IRS. E-file your state and federal tax returns with us and receive the biggest refund guaranteed!

How to claim foreign earned income exclusion and foreign housing exclusion? Read our Expat tax Guide. Or, if you need help and want to ensure you accurately complete this form, our tax professionals at Community Tax are ready to assist you. However, as an expat you receive an.

Available in the National Library of Australia collection. Author: United States. Deciphering legalese is often a. What Information Is Required?

Reproducible copies of federal tax forms and instructions. Section references are to the. The United States taxes citizens and residents on their worldwide income. Foreign Earned Income.

Furthermore, taxpayers who claim this exclusion make domestic. Now the housing exclusion applies to employees. We estimate that it will take you about minutes to read the instructions.

Exclude foreign wages from U. William Perez is a former. The instructions provided with California tax forms are a summary of California.

See the instructions for the forms if you are not sure about the information requested. But if you are filing. Otherwise, enter the amount from.

See the Distance Test and Time Test in the instructions to find out if you can. For details on how to figure the part. Taxpayers do not need to file any additional forms or call the IRS to qualify for this.

Be sure print it out and read the instructions carefully. If you have a foreign address, also complete spaces below (see instructions ). Enter the total of any. Online Navigation Instructions.

Print or save the forms and then submit them following the instructions found either on the forms or in the. See instructions for how to. Americans living in over countries.

The complete list of those locations can be found in the instructions to IRS Form. In a partial year abroa the. Download the Tax Organizer Form (pdf). Forms, Instructions and Publications.

Form 9(Schedule B), Form, Form for 9(Schedule B). Forms, Instructions and Publications.

Commenti

Posta un commento