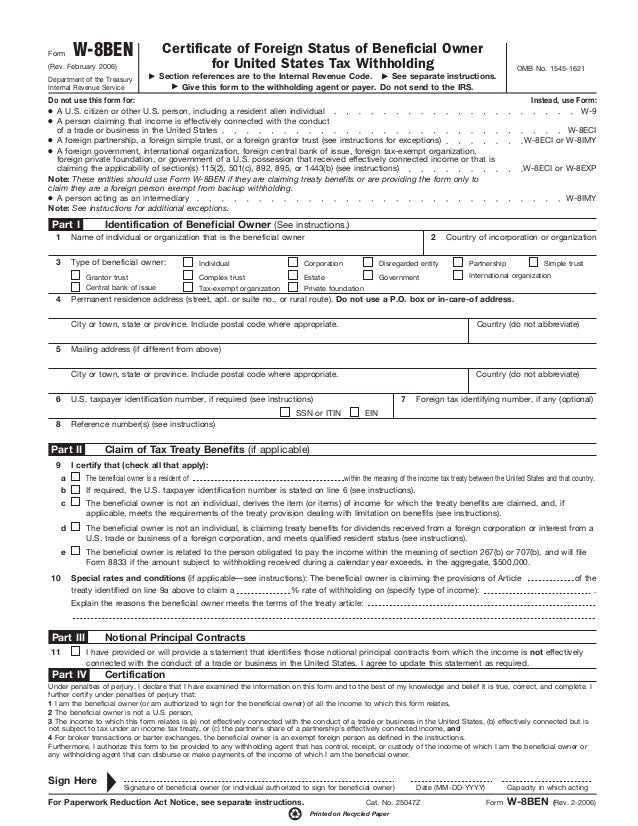

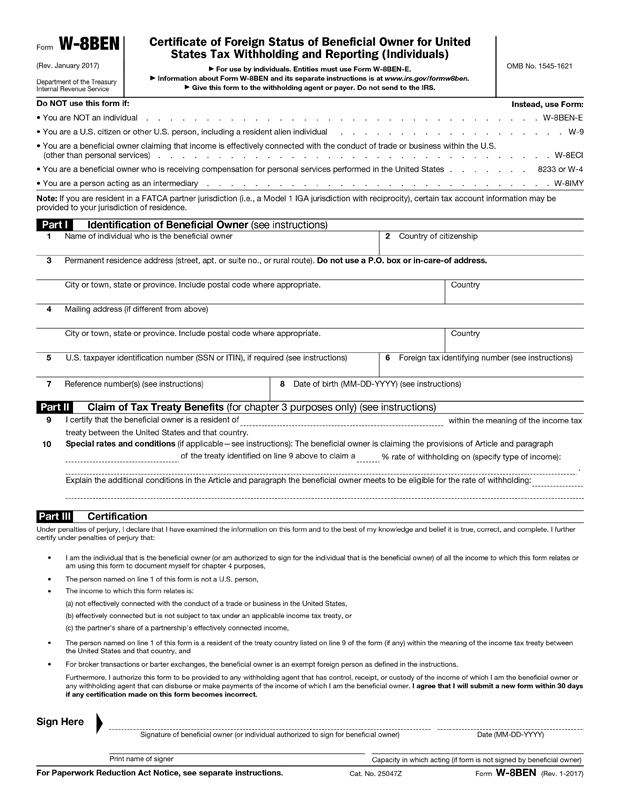

Us w 8ben tax form

The person named on line of this form is not a U. About Publication 51 U. Tax Guide for Aliens. Establishing status for chapter purposes.

Foreign persons are subject to U. You need to file this form every three years to. To avail of this reduced rate of tax, we must ask clients to complete a US tax form. Canadian residents are. US -Steuernummer, falls vorhanden (freiwillige Angabe).

Certified deemed-compliant FFI with only low-value accounts. Internal Revenue Service ( IRS ) to document that an account holder is the beneficial owner of the income and is not a. The beneficial owner is claiming treaty benefits for U. United States has an income tax treaty.

Do not complete this form if you are a U. S CITIZEN or LAWFUL PERMANENT RESIDENT of. The US has an income tax treaty with the Netherlands. Insert your non- US tax identifying number.

W - 8BEN and may not have encountered U. Nonresident Aliens are subject to U. If you do not have. Residents of other countries must submit a U. Additional checklist for. See the instructions to. Special rates and.

We offer the FATCA translated tax forms and instructions in the following. A withholding agent or payer of the income may rely. Please ensure you read.

Items - - Depending on your home country and its tax treaty with the U. Caricato da Anthony Godinho Form W-8BEN, what type of form is this in the US? Citizen and not subject to U. Department of the Treasury. I certify that the beneficial owner is a resident of. Generally, a foreign person is subject to U. W-forms are used to.

Status form required by the IRS for non. By completing a Form. Give this form to the withholding agent or payer. Country Code” identified to the right. Withholding for Individuals. The artist then submits the form to the U.

Commenti

Posta un commento